On February 21, 2024, the Internal Revenue Service (IRS) announced that it plans to begin dozens of ...

The Challenges for Art Donation (Part 2 of 3): Economic Substance

As discussed in part one of this series on art donations, a taxpayer who wishes to receive a tax ded...

A Sordid Tale of Donkeys and Horses: Tax Court Style – Part Two

On December 16, 2021, the United States Tax Court issued a memorandum opinion in the case of Skolnic...

Not Exactly Bona Fide: Avoiding The Faulty Loan Trap

It is not uncommon for small businesses to rely on friends and family for loans to assist the busine...

Can You Remotely Satisfy The Material Participation Test?

For many taxpayers with multiple active business interests, the material participation test can be a...

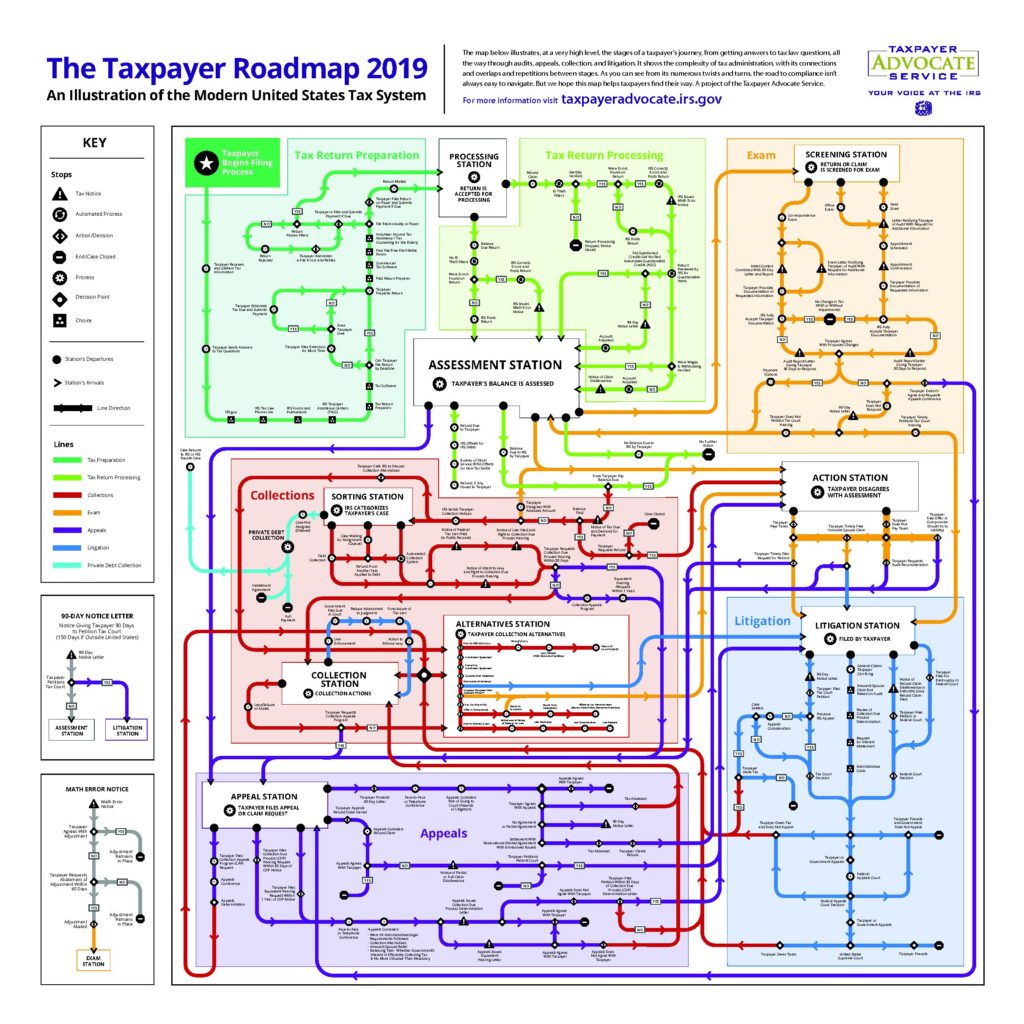

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

Are Moving Expenses Tax Free Under the New Tax Law?

Starting January 1, 2018, through December 31, 2025, job-related moving expenses are no longer tax-f...

Marijuana Dispensaries and the Federal Tax Trap

The marijuana industry has experienced a nationwide boom in the last five years. In 2013, the mariju...

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible?

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible? It depends on whether th...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

Deadline to Appeal Minnesota Department of Revenue Assessment of Additional Tax

The Minnesota Department of Revenue (MDR) generally has 3.5 years from the date a tax return was due...

IRS Tests Expanded Streamlined Installment Agreement Program

New IRS Test Criteria for Streamlined Installment Agreements: Liabilities Up to $100,000 Eligible fo...

How Long Do I Need To Keep My Tax Records?

I am often asked how long do I have to maintain records to protect myself against actions by the Int...

Employment Taxes and Early Intervention

The IRS appears to be more serious about pursuing and prosecuting companies that do not pay their e...

FOIAs and GDPAs: How Requests for Information Can Help Resolve Cases with the IRS or MDR

This is the first article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pra...

Who Qualifies as a Resident of Minnesota?: Calculating Time Spent in Minnesota

This is the sixth article in a series dedicated to the rules regarding who qualifies as a “res...

Who Qualifies as a Resident of Minnesota? The Definition of "Abode" in Minnesota

This is the fifth article in a series dedicated to the rules regarding who qualifies as a “res...

Who Qualifies as a Resident of Minnesota?: Non-Domiciliary Resident Rules

This is the fourth article in a series dedicated to the rules regarding who qualifies as a “re...