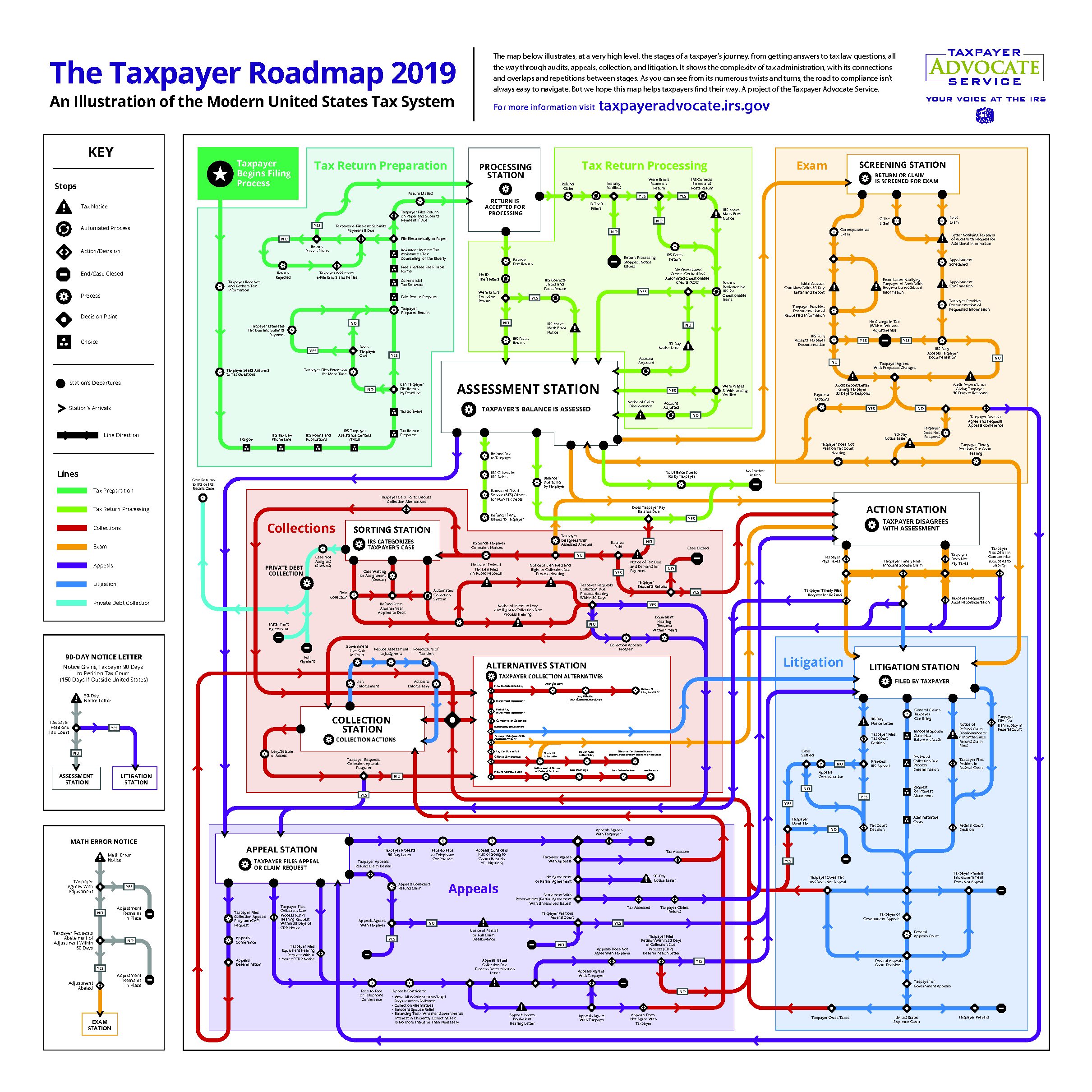

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “subway map” to illustrate, at a very high level, the stages of a taxpayer’s journey through the tax system. The map provides a high level overview of the processes for tax return preparation, tax return processing, notices from the IRS, audits, appeals, collection, and litigation.

The purpose of the map is to help taxpayers and policymakers gain a better understanding of the tax administration process. The map demonstrates the complexity of tax administration, including connections, overlaps, and repetitions between stages.

The map is now available to view online and in hard copy as a print map. The TAS also offers a video introduction of the map. To place an order for a print copy of the map, call 800-829-3676 and request Publication 5341.

Nina Olson, former head of the Office of the Taxpayer Advocate, noted that “Anyone looking at this map will understand that we have an incredibly complex tax system that is almost impossible for the average taxpayer to navigate.”

Despite its detail, the current tax map is not comprehensive. Due to the complexity and number of steps at each stage, the map simplified certain processes by omitting multiple sub-steps and detours that, in some situations, can be significant.

The TAS is working to provide a more complete picture of the federal tax system by developing a fully interactive version of the map in the coming year. The goal for the interactive map will be to allow a taxpayer to enter into it at any step and learn more about that step and the surrounding steps.

As illustrated by the tax map, navigating the federal audit, appeal, and litigation processes can be complicated. It can be helpful for a taxpayer navigating these processes to have the assistance of a tax professional. Our office specializes in assisting taxpayers with federal audit, appeal, and litigation matters.