In February of 2020, the United States Tax Court issued a Memo, Railroad Holdings, LLC T.C. Memo. 20...

The Challenges for Art Donation (Part 3 of 3): Trouble with $0 Donations

When it comes to the charitable donation of art, the Internal Revenue Service (IRS) has increasingly...

The Challenges for Art Donation (Part 2 of 3): Economic Substance

As discussed in part one of this series on art donations, a taxpayer who wishes to receive a tax ded...

Government Transparency: Commissioner of Revenue to be Bound by Tax Court Decisions

On April 2, 2024, Senate File (SF) 4742, as a companion to House File (HF) 4934, was subject to a he...

Government Transparency: Commissioner of Revenue to be Bound by Court Decisions

On Thursday, March 21, 2024, the Minnesota Senate Tax Committee had a hearing regarding Chair Ann Re...

Anticipating Tax Litigation… And the IRS (Part 1 of 2): Tax Filing and Maintenance Tips

Despite the relative rarity of an individual taxpayer’s file being brought to United States Tax Co...

IRS Acted “Against Equity or Good Conscience” to Deny Hardship Due to Depression

On April 20, 2017, the United States Tax Court (Court) held in favor the petitioners, John C. Trimme...

A Qualified Offer the IRS Could Refuse

The Internal Revenue Service (IRS), like any self-respecting bureaucracy, sometimes makes mistakes. ...

Not Exactly Bona Fide: Avoiding The Faulty Loan Trap

It is not uncommon for small businesses to rely on friends and family for loans to assist the busine...

Can You Remotely Satisfy The Material Participation Test?

For many taxpayers with multiple active business interests, the material participation test can be a...

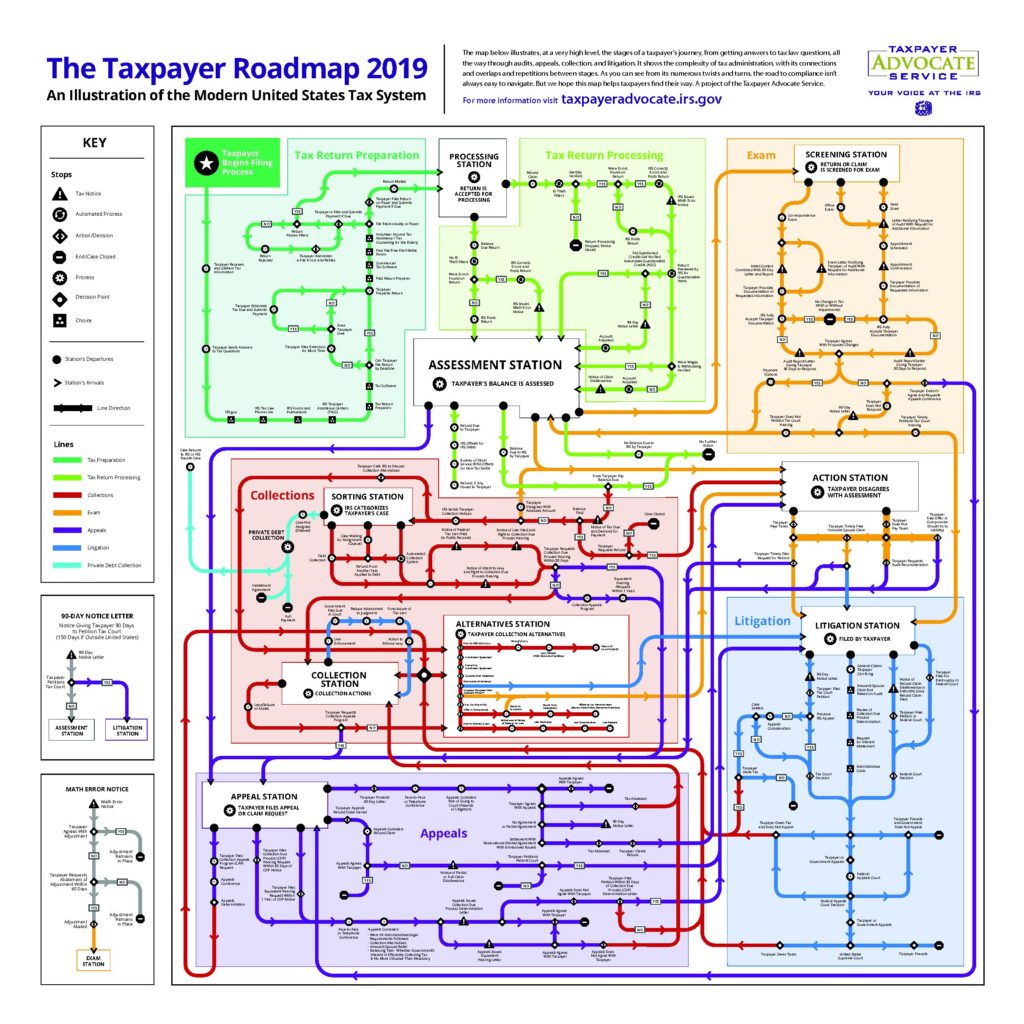

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

Another Tax Blow To The Marijuana Industry

The marijuana industry remains in a difficult position when it comes to the federal tax implications...

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible?

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible? It depends on whether th...

Winning A Tax Battle, But Losing the Tax War

A recent U.S. Tax Court decision in Barker v. Comm’r of Internal Revenue, T.C. Memo. 2018-67 exemp...

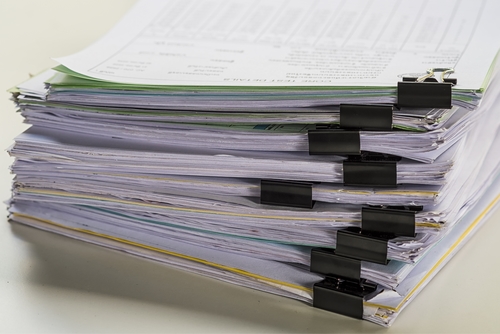

How Long Do I Need To Keep My Tax Records?

I am often asked how long do I have to maintain records to protect myself against actions by the Int...

Real Estate Professional – Maintaining Adequate Records

Doing well in a full time job is hard enough, but some people, for many reasons, spend significant t...

Filing and Serving Documents in United States Tax Court Proceedings

Federal and state courts continue to evolve as technology evolves. The United States Tax Court is no...

Innocent Spouse Relief- IRS Modifies Section 6015(f), Equitable Relief Rules

On January 5, 2012, in Notice 2012-8, the IRS significantly modified the rules for spouses seeking I...

Taking Your Case To The United States Tax Court

While most taxpayers can resolve their situation with the Internal Revenue Service (IRS) without ask...