Since the COVID-19 pandemic, the Internal Revenue Service (IRS) has had a long backlog that, due in ...

IRS Prevails In Pursuing An Alter Ego Assessment

Corporate income taxes are generally the responsibility of the corporation and not the individuals t...

IRS Offers Additional Taxpayer Relief in Response to Covid-19

On March 25, 2020, the Internal Revenue Service (IRS) released guidance related to its “People Fir...

IRS Provides Additional Guidance To Passport Revocation Process

In January of 2018, the Internal Revenue Service (IRS) issued a press release advising delinquent ta...

How to Appeal the Trust Fund Recovery Penalty After the Appeal Period has Passed: Offer in Compromise, Doubt as to Liability

There are many reasons businesses fall behind on paying their federal tax liabilities. Falling behin...

IRS To Increase Focus On Delinquent-Filed Returns

The Internal Revenue Service (IRS) announced, in a recent Information Release and Fact Sheet, that i...

State Sales Tax and Corporate Income and Franchise Tax After Wayfair

On June 21, 2018, The United States Supreme Court ruled 5-4 in South Dakota v. Wayfair that states c...

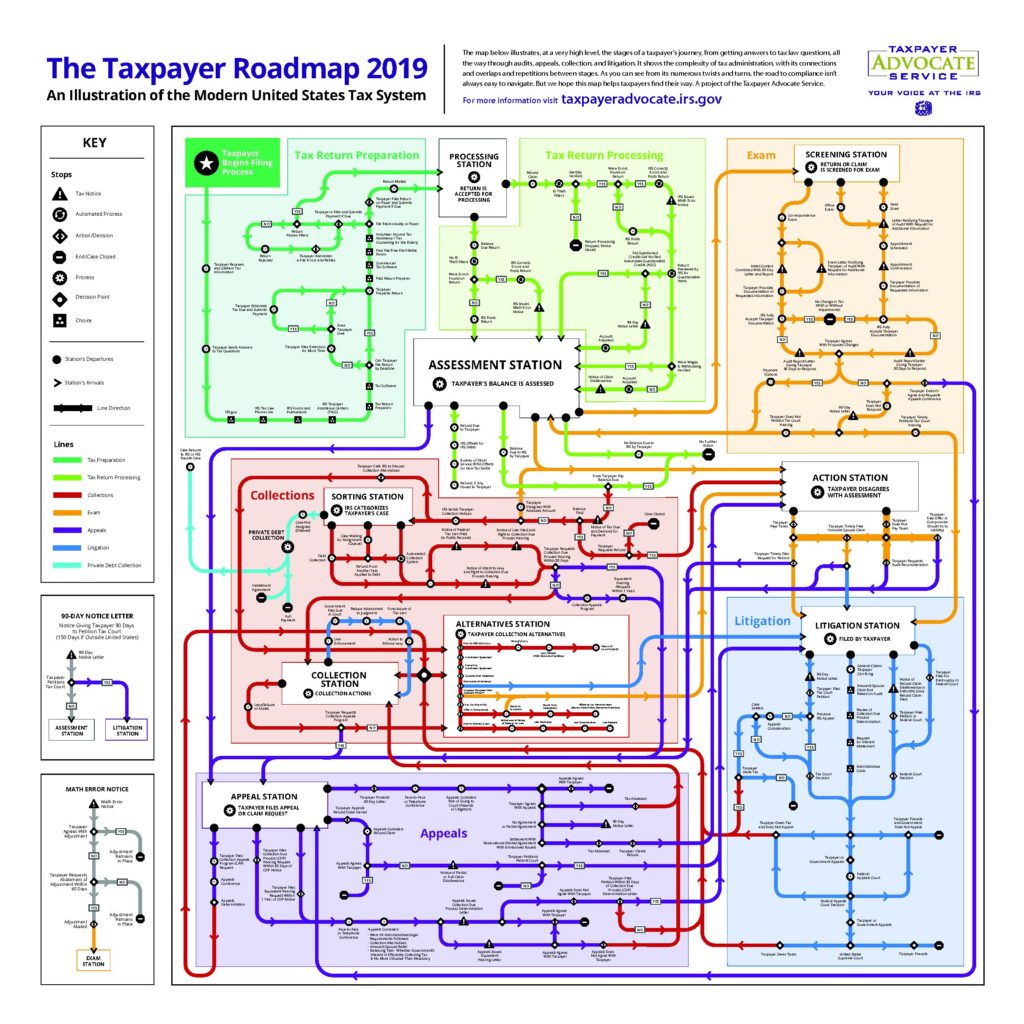

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

Can the IRS Can Foreclose on My Home?

Yes. If you owe money to the Internal Revenue Service (IRS), the IRS has many tools it may use to co...

How Does an Employer Comply with an IRS Wage Levy?

When an individual has outstanding federal tax liabilities, the Internal Revenue Service (IRS) has a...

Are Moving Expenses Tax Free Under the New Tax Law?

Starting January 1, 2018, through December 31, 2025, job-related moving expenses are no longer tax-f...

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible?

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible? It depends on whether th...

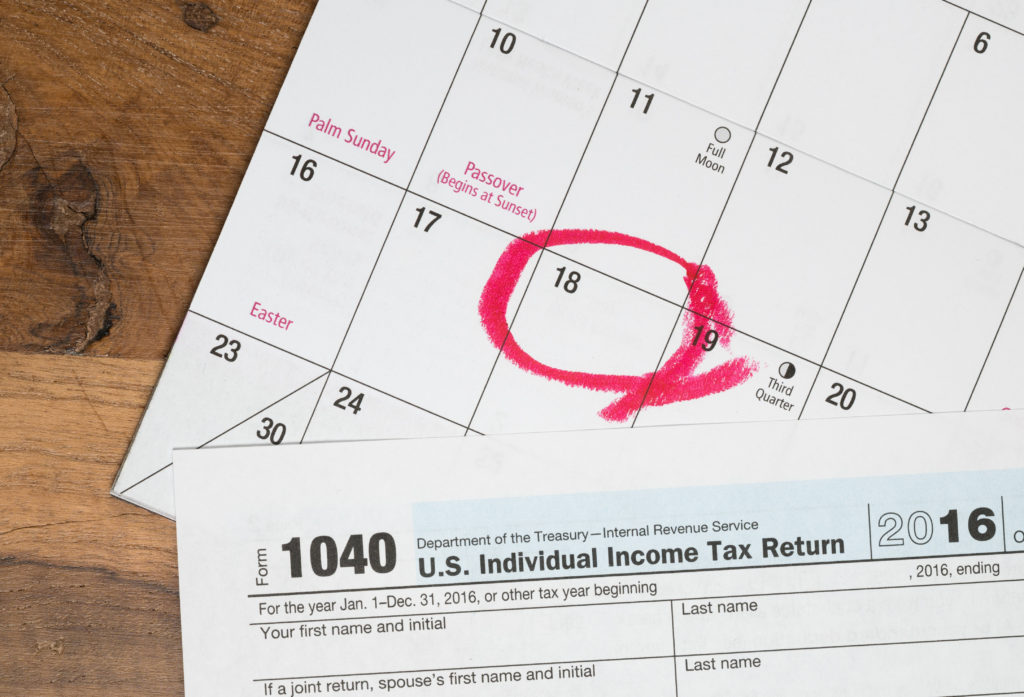

I missed the deadline to file my tax return. Now what?

I missed the deadline to file my tax return. Now what? The deadline for individual taxpayers to file...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

IRS Tests Expanded Streamlined Installment Agreement Program

New IRS Test Criteria for Streamlined Installment Agreements: Liabilities Up to $100,000 Eligible fo...

How Long Do I Need To Keep My Tax Records?

I am often asked how long do I have to maintain records to protect myself against actions by the Int...

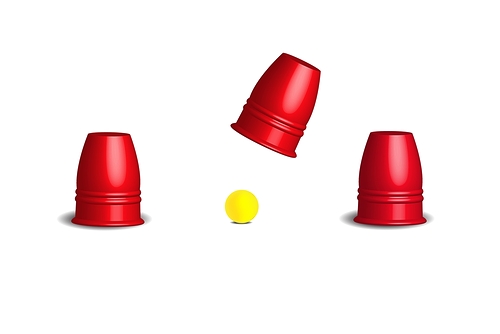

Notice of Right to a Collection Due Process Hearing – Is the IRS Trying to Hide the Ball?

The IRS must give a taxpayer written notice, sent by certified mail, at least 30 days before it take...

Late Returns and Discharging Taxes in Bankruptcy

If you want the chance to discharge your individual income taxes in bankruptcy, in Minnesota, file y...