Recently, I wrote an article for the Hennepin County Lawyer addressing some of the kinds of tax ques...

What To Do if I Can’t Pay My Taxes by the IRS’s July 15 Tax Deadline

In light of the current Covid-19 ...

IRS Releases People First Initiative FAQs

On March 25, 2020, the Internal Revenue Service (IRS) announced its “People First Initiative,” a...

IRS Response to Covid-19: “People First Initiative” Extends Certain Payment Deadlines and Collection Action

On March 25, 2020, the Internal Revenue Service (IRS) released guidance related to its “People Fir...

Update: Important Provisions of the CARES Act for Individuals and Small Businesses

On March 27, 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (CARES Act...

How to Appeal the Trust Fund Recovery Penalty After the Appeal Period has Passed: Offer in Compromise, Doubt as to Liability

There are many reasons businesses fall behind on paying their federal tax liabilities. Falling behin...

State Sales Tax and Corporate Income and Franchise Tax After Wayfair

On June 21, 2018, The United States Supreme Court ruled 5-4 in South Dakota v. Wayfair that states c...

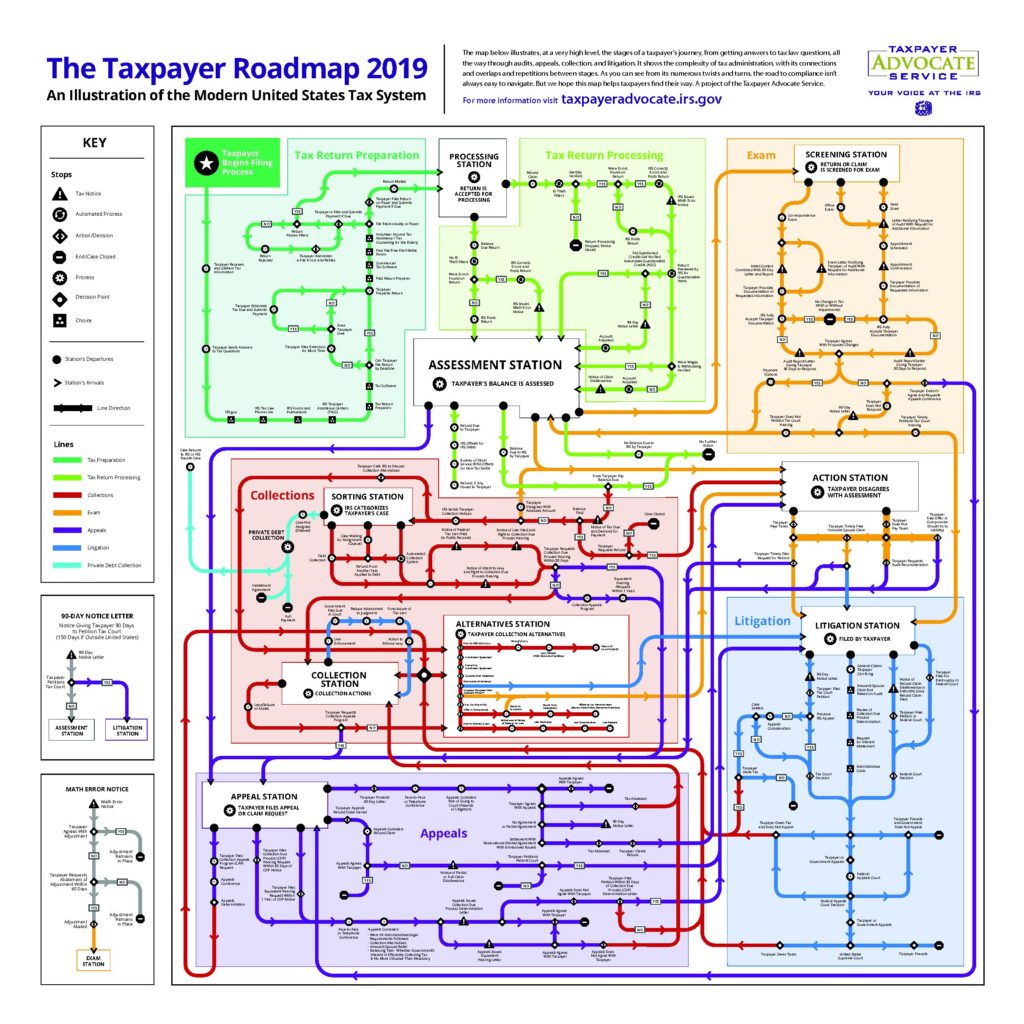

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

IRS Announces Increase to Late Filing Penalties for 2018 Federal Tax Returns

The IRS recently announced that taxpayers who owe tax and did not file their 2018 returns before Fri...

Can the IRS Can Foreclose on My Home?

Yes. If you owe money to the Internal Revenue Service (IRS), the IRS has many tools it may use to co...

How Does an Employer Comply with an IRS Wage Levy?

When an individual has outstanding federal tax liabilities, the Internal Revenue Service (IRS) has a...

Are Moving Expenses Tax Free Under the New Tax Law?

Starting January 1, 2018, through December 31, 2025, job-related moving expenses are no longer tax-f...

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible?

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible? It depends on whether th...

I missed the deadline to file my tax return. Now what?

I missed the deadline to file my tax return. Now what? The deadline for individual taxpayers to file...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

Deadline to Appeal Minnesota Department of Revenue Assessment of Additional Tax

The Minnesota Department of Revenue (MDR) generally has 3.5 years from the date a tax return was due...

IRS Tests Expanded Streamlined Installment Agreement Program

New IRS Test Criteria for Streamlined Installment Agreements: Liabilities Up to $100,000 Eligible fo...

Reinstating Defaulted IRS Installment Agreements

Defaulted Installment Agreements The IRS expects taxpayers to pay all of their tax liabilities in fu...