The Internal Revenue Service (IRS) can utilize its jeopardy levy function (i.e., taking a taxpayer�...

How Does an Employer Comply with an IRS Wage Levy?

When an individual has outstanding federal tax liabilities, the Internal Revenue Service (IRS) has a...

The IRS’s Expanding Definition Of Willfulness In FBAR Cases

The Internal Revenue Service’s (IRS’s) Offshore Voluntary Disclosure Program (Program) has eleme...

Marijuana Dispensaries and the Federal Tax Trap

The marijuana industry has experienced a nationwide boom in the last five years. In 2013, the mariju...

I missed the deadline to file my tax return. Now what?

I missed the deadline to file my tax return. Now what? The deadline for individual taxpayers to file...

Does the Internal Revenue Service’s “willfulness” standard in Trust Fund Recovery Penalty cases include a “reasonable cause” defense?

The recent Sixth Circuit decision in Bibler v. U.S., 2018 WL 1911249, may mark an evolution of the d...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

IRS Adopts The In-Person Approach

The Internal Revenue Service (IRS) had an interesting New Year’s resolution for 2018: more in-pers...

The IRS Adds Passport Revocation To Its Collections Arsenal

On January 16, 2018, the Internal Revenue Service (IRS) issued a press release emphasizing that taxp...

Reinstating Defaulted IRS Installment Agreements

Defaulted Installment Agreements The IRS expects taxpayers to pay all of their tax liabilities in fu...

FOIAs and GDPAs: How Requests for Information Can Help Practitioners Resolve Cases with the IRS or DOR

This is the sixth article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pra...

FOIAs and GDPAs: How Requests for Information Can Help Practitioners Resolve Cases with the IRS or DOR

This is the fifth article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pra...

Divorce Decree Drafting Part 4

This is the fourth article in a four part series addressing frequently asked questions relating to p...

FOIAs and GDPAs: How Requests for Information Can Help Practitioners Resolve Cases with the IRS or DOR

This is the fourth article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pr...

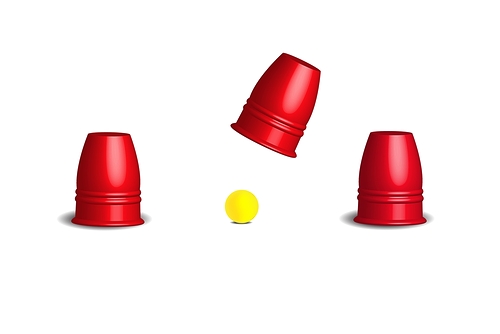

Notice of Right to a Collection Due Process Hearing – Is the IRS Trying to Hide the Ball?

The IRS must give a taxpayer written notice, sent by certified mail, at least 30 days before it take...

Divorce Decree Drafting Part 3

This is the third article in a four part series addressing frequently asked questions related to pro...

FOIAs and GDPAs: How Requests for Information Can Help Practitioners Resolve Cases with the IRS or DOR

This is the third article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pra...

Divorce Decree Drafting Part 2

This is the second article in a four part series addressing frequently asked questions related to pr...

FOIAs and GDPAs: How Requests for Information Can Help Resolve Cases with the IRS or MDR

This is the second article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pr...

Explaining the Basics of the Quiet Disclosure of an FBAR

This is the sixth article in the Offshore Voluntary Disclosure Program (OVDP) Frequently Asked Quest...