On October 24, 2024, Commissioner Daniel Werfel announced that the Internal Revenue Service (IRS) wo...

Employee Retention Credit Voluntary Disclosure Program Ends March 22, 2024

The Employee Retention Credit (ERC) is a refundable tax credit for certain eligible business and tax...

When Winning Isn’t “Prevailing”: Success in Bankruptcy Court Does Not Translate to Attorneys’ Fees

In June 2016, William Canada, Jr. took the Internal Revenue Service (IRS) to bankruptcy court and wo...

IRS Acted “Against Equity or Good Conscience” to Deny Hardship Due to Depression

On April 20, 2017, the United States Tax Court (Court) held in favor the petitioners, John C. Trimme...

How to Appeal the Trust Fund Recovery Penalty After the Appeal Period has Passed: Offer in Compromise, Doubt as to Liability

There are many reasons businesses fall behind on paying their federal tax liabilities. Falling behin...

State Sales Tax and Corporate Income and Franchise Tax After Wayfair

On June 21, 2018, The United States Supreme Court ruled 5-4 in South Dakota v. Wayfair that states c...

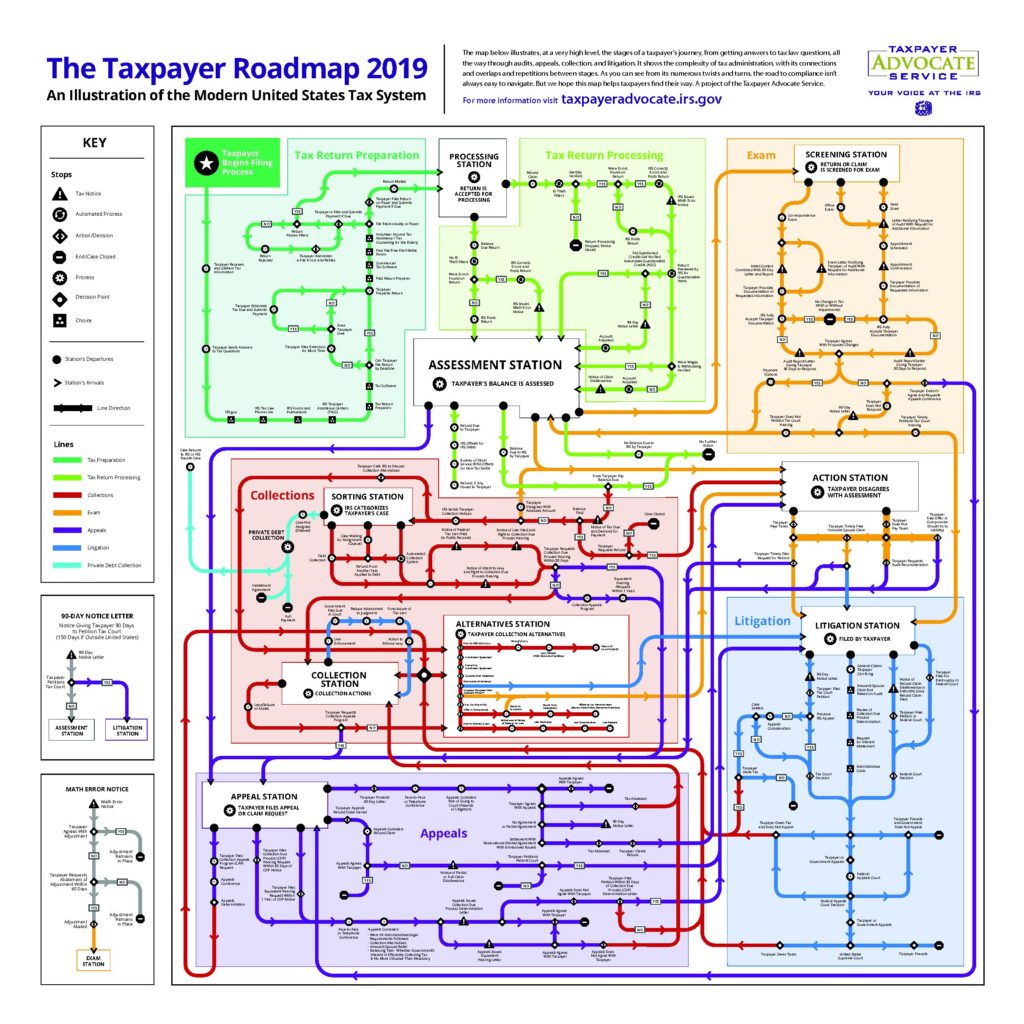

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

IRS Announces Increase to Late Filing Penalties for 2018 Federal Tax Returns

The IRS recently announced that taxpayers who owe tax and did not file their 2018 returns before Fri...

Taking Advantage Of Expanded Penalty Relief

The recent enactment of the Tax Cut and Jobs Act (TCJA) put many individual taxpayers in a difficult...

I missed the deadline to file my tax return. Now what?

I missed the deadline to file my tax return. Now what? The deadline for individual taxpayers to file...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

Relying On the Advice of an Accountant – When Does It Constitute Reasonable Cause to Abate a Late Filing Penalty?

The U.S. Supreme Court recently refused to hear an appeal from the Ninth Circuit Court of Appeals in...

Should I File My Federal Individual Income Tax Return Even If I Have A Balance Due?

A common misperception for taxpayers is that by refraining from filing, they will buy themselves tim...

Valuations Misstatements and the IRS Accuracy Penalty (IRC Section 6664(c))

I have been watching the tax cases dealing with building facade easements for insight into how the I...

MDR Penalties – Late Filing and Late Payment

Taxpayers who do not timely file their returns or timely pay their obligations will be subject to pe...

IRS Penalties – Late Filing and Late Payment

Many taxpayers are unable to timely file their returns or timely pay their obligations. When this ha...