The Employee Retention Credit (ERC) is a refundable tax credit for certain eligible business and tax...

Anticipating Tax Litigators…And the IRS (Part 2 of 2): Tax Strategy Tips

Since the COVID-19 pandemic, the Internal Revenue Service (IRS) has had a long backlog that, due in ...

Anticipating Tax Litigation… And the IRS (Part 1 of 2): Tax Filing and Maintenance Tips

Despite the relative rarity of an individual taxpayer’s file being brought to United States Tax Co...

State Sales Tax and Corporate Income and Franchise Tax After Wayfair

On June 21, 2018, The United States Supreme Court ruled 5-4 in South Dakota v. Wayfair that states c...

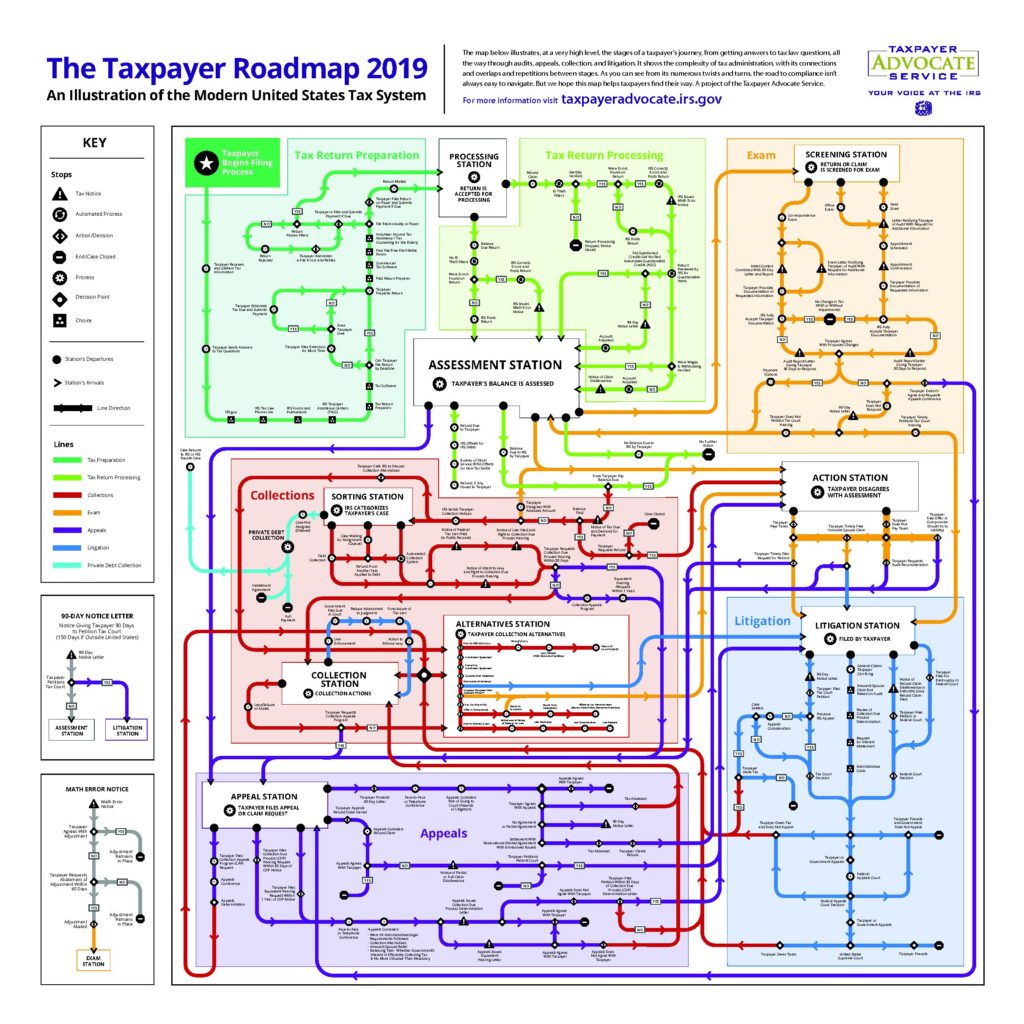

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

IRS Announces Increase to Late Filing Penalties for 2018 Federal Tax Returns

The IRS recently announced that taxpayers who owe tax and did not file their 2018 returns before Fri...

Are Moving Expenses Tax Free Under the New Tax Law?

Starting January 1, 2018, through December 31, 2025, job-related moving expenses are no longer tax-f...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

Deadline to Appeal Minnesota Department of Revenue Assessment of Additional Tax

The Minnesota Department of Revenue (MDR) generally has 3.5 years from the date a tax return was due...

IRS Tests Expanded Streamlined Installment Agreement Program

New IRS Test Criteria for Streamlined Installment Agreements: Liabilities Up to $100,000 Eligible fo...

How Long Do I Need To Keep My Tax Records?

I am often asked how long do I have to maintain records to protect myself against actions by the Int...

Employment Taxes and Early Intervention

The IRS appears to be more serious about pursuing and prosecuting companies that do not pay their e...

Relying On the Advice of an Accountant – When Does It Constitute Reasonable Cause to Abate a Late Filing Penalty?

The U.S. Supreme Court recently refused to hear an appeal from the Ninth Circuit Court of Appeals in...

Section 530 – Reasonable Basis

This is the fourth article in a series dedicated to using Section 530 of the Revenue Act of 1978 as...

Section 530 – Substantive Consistency

This is the third article in a series dedicated to using Section 530 of the Revenue Act of 1978 as p...

Substantiating Business Expenses in Audits – Special Rules for Travel, Meals and Entertainment, Gifts, and any “Listed” Property Expenses

Substantiating business expenses is a common problem for many businesses going through an audit with...

Section 530 – Reporting Consistency

This is the second article in a series dedicated to using Section 530 of the Revenue Act of 1978 as ...

Substantiating Business Expenses in Audits – Step Four: Proving a Business Expense is “Necessary”

Substantiating business expenses is a common problem for businesses going through an audit wi...

Substantiating Business Expenses in Audits – Step Three: Proving a Business Expense is “Ordinary”

Substantiating business expenses is a common problem for many businesses going through an audit with...