On March 9, 2022, President Biden signed an executive order setting out his administration’s strat...

A Sordid Tale of Donkeys and Horses: Tax Court Style – Part Two

On December 16, 2021, the United States Tax Court issued a memorandum opinion in the case of Skolnic...

A Sordid Tale of Donkeys and Horses: Tax Court Style – Part One

The following tale is the first in a two part series relating to a couple of recent decisions from t...

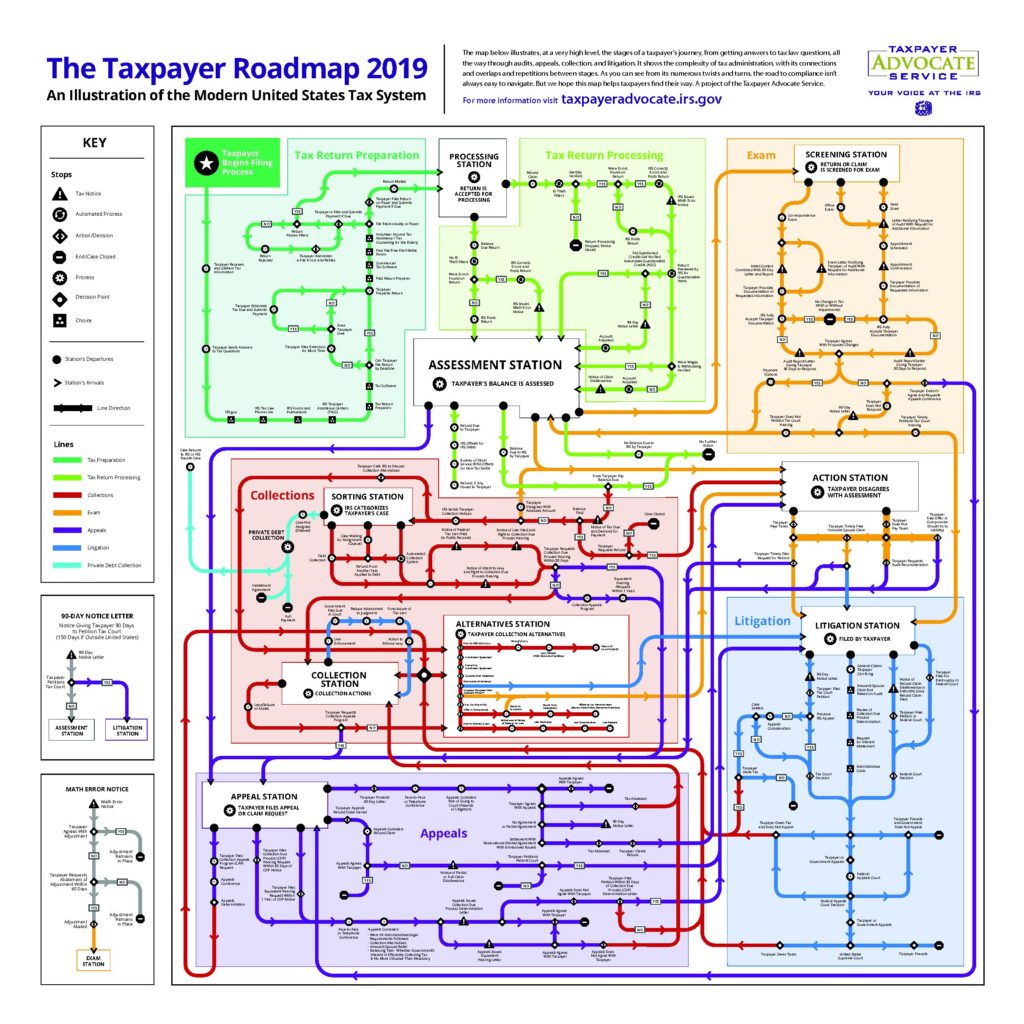

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

IRS Tests Expanded Streamlined Installment Agreement Program

New IRS Test Criteria for Streamlined Installment Agreements: Liabilities Up to $100,000 Eligible fo...

Relying On the Advice of an Accountant – When Does It Constitute Reasonable Cause to Abate a Late Filing Penalty?

The U.S. Supreme Court recently refused to hear an appeal from the Ninth Circuit Court of Appeals in...

Can an In-Business Corporation Compromise its Employment Tax Obligations With The IRS?

Yes. An in-business corporation can compromise its outstanding employment tax obligations with the I...