In June 2016, William Canada, Jr. took the Internal Revenue Service (IRS) to bankruptcy court and wo...

How to Appeal the Trust Fund Recovery Penalty After the Appeal Period has Passed: Offer in Compromise, Doubt as to Liability

There are many reasons businesses fall behind on paying their federal tax liabilities. Falling behin...

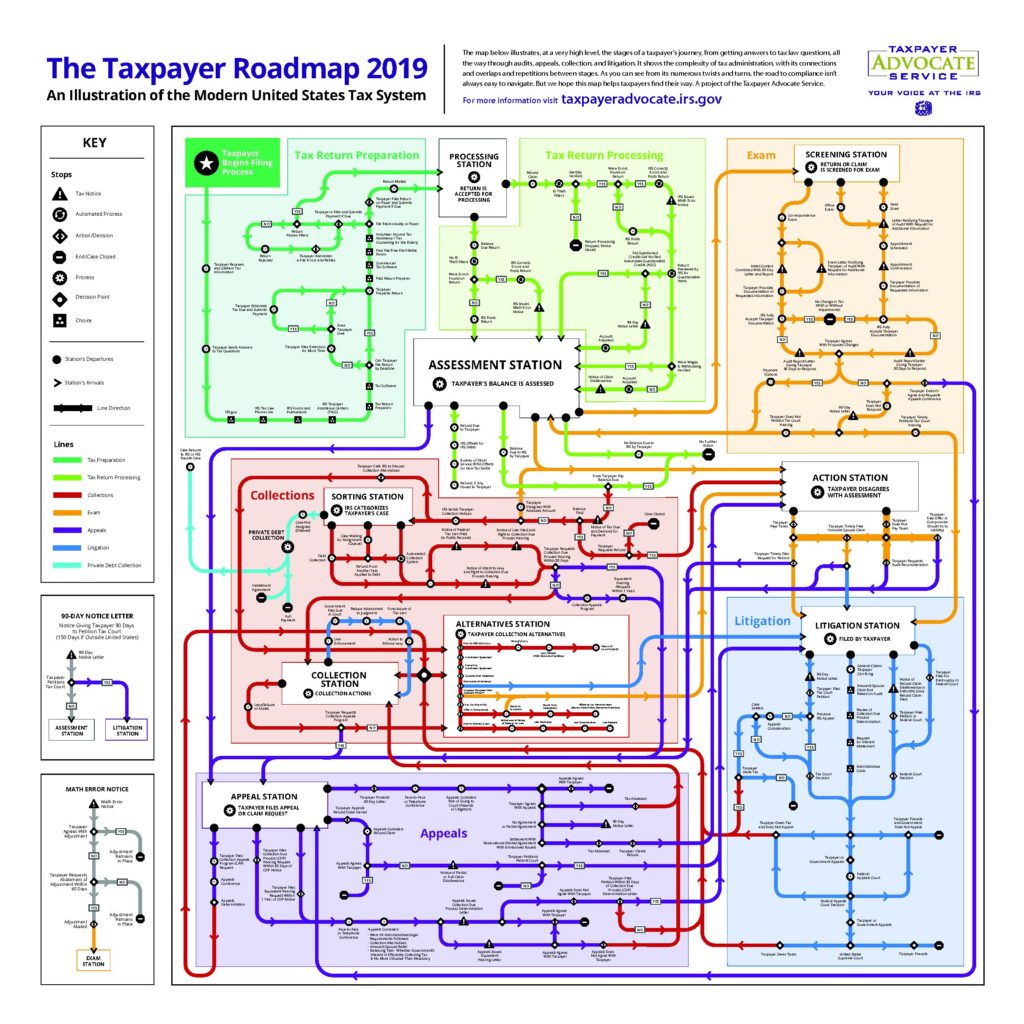

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

IRS Announces Increase to Late Filing Penalties for 2018 Federal Tax Returns

The IRS recently announced that taxpayers who owe tax and did not file their 2018 returns before Fri...

Can the IRS Can Foreclose on My Home?

Yes. If you owe money to the Internal Revenue Service (IRS), the IRS has many tools it may use to co...

Are Moving Expenses Tax Free Under the New Tax Law?

Starting January 1, 2018, through December 31, 2025, job-related moving expenses are no longer tax-f...

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible?

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible? It depends on whether th...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

Deadline to Appeal Minnesota Department of Revenue Assessment of Additional Tax

The Minnesota Department of Revenue (MDR) generally has 3.5 years from the date a tax return was due...

IRS Tests Expanded Streamlined Installment Agreement Program

New IRS Test Criteria for Streamlined Installment Agreements: Liabilities Up to $100,000 Eligible fo...

FOIAs and GDPAs: How Requests for Information Can Help Resolve Cases with the IRS or MDR

This is the first article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pra...

Who Qualifies as a Resident of Minnesota?: Calculating Time Spent in Minnesota

This is the sixth article in a series dedicated to the rules regarding who qualifies as a “res...

Who Qualifies as a Resident of Minnesota? The Definition of "Abode" in Minnesota

This is the fifth article in a series dedicated to the rules regarding who qualifies as a “res...

Who Qualifies as a Resident of Minnesota?: Non-Domiciliary Resident Rules

This is the fourth article in a series dedicated to the rules regarding who qualifies as a “re...

Who Qualifies as a Resident of Minnesota?: Domiciliary Resident Status

This is the first article in a series dedicated to the rules regarding who qualifies as a “res...

Substantiating Business Expenses in Audits – Step Three: Proving a Business Expense is “Ordinary”

Substantiating business expenses is a common problem for many businesses going through an audit with...

Relief for Businesses Using Independent Contractors: Section 530 is Still a Viable Option

This is the first article in a series dedicated to using Section 530 of the Revenue Act of 1978 as p...

IRS Statute of Limitations on Assessment for Individual Income Taxes: Exceptions and Considerations

Taxpayers and representatives often ask us: how long does the IRS have to make changes to an individ...