Since the COVID-19 pandemic, the Internal Revenue Service (IRS) has had a long backlog that, due in ...

What To Do if I Can’t Pay My Taxes by the IRS’s July 15 Tax Deadline

In light of the current Covid-19 ...

Working With Taxing Authorities During The Coronavirus Pandemic

The recently imposed social distancing measures that are critical and essential to our nation’s ba...

How to Appeal the Trust Fund Recovery Penalty After the Appeal Period has Passed: Offer in Compromise, Doubt as to Liability

There are many reasons businesses fall behind on paying their federal tax liabilities. Falling behin...

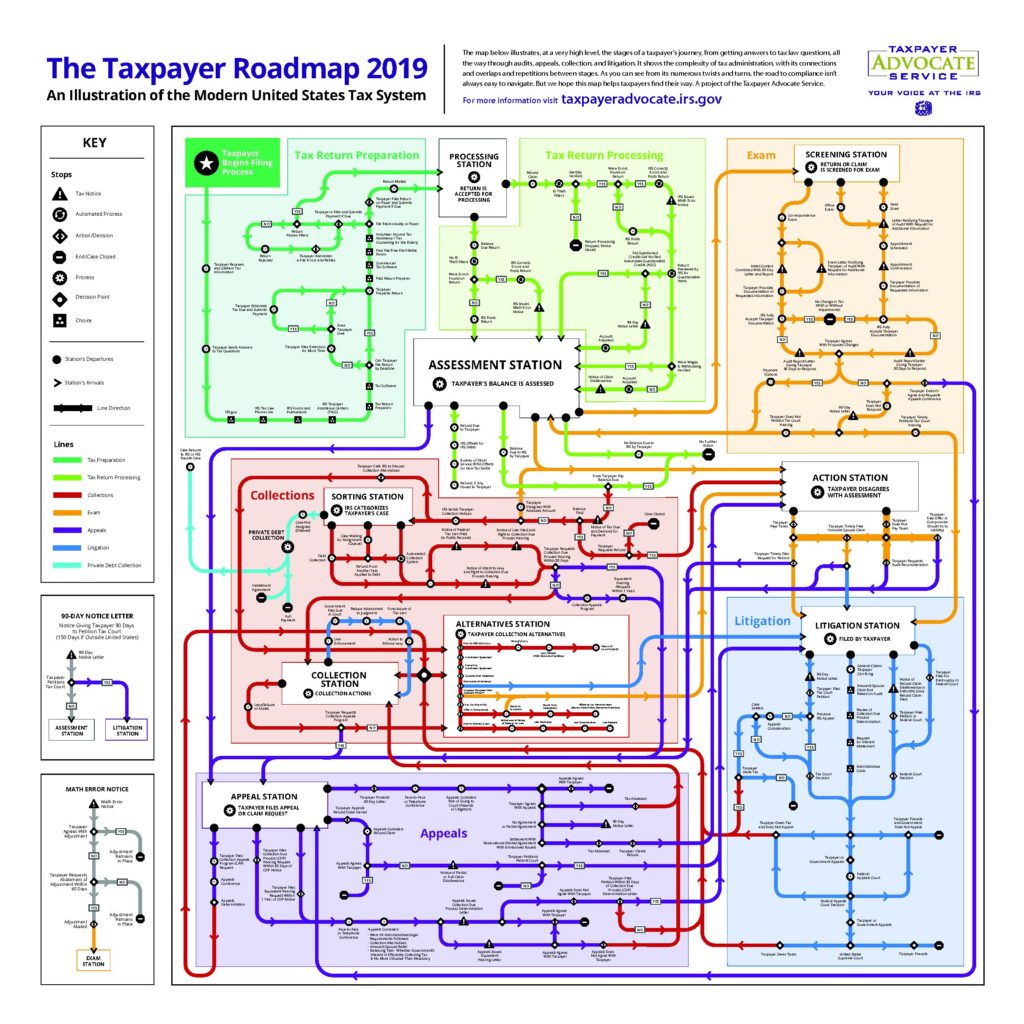

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

Can the IRS Can Foreclose on My Home?

Yes. If you owe money to the Internal Revenue Service (IRS), the IRS has many tools it may use to co...

Can The IRS Really Seize My Assets Without Telling Me First?

The Internal Revenue Service (IRS) can utilize its jeopardy levy function (i.e., taking a taxpayer�...

How Does an Employer Comply with an IRS Wage Levy?

When an individual has outstanding federal tax liabilities, the Internal Revenue Service (IRS) has a...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

IRS Adopts The In-Person Approach

The Internal Revenue Service (IRS) had an interesting New Year’s resolution for 2018: more in-pers...

IRS Tests Expanded Streamlined Installment Agreement Program

New IRS Test Criteria for Streamlined Installment Agreements: Liabilities Up to $100,000 Eligible fo...

The IRS Adds Passport Revocation To Its Collections Arsenal

On January 16, 2018, the Internal Revenue Service (IRS) issued a press release emphasizing that taxp...

Late Returns and Discharging Taxes in Bankruptcy

If you want the chance to discharge your individual income taxes in bankruptcy, in Minnesota, file y...

Offer in Compromise – Is It An Option?

We regularly receive calls from people who tried to resolve their tax obligations through an Offer i...

I Owe the IRS Money – What Can I Do?

We often receive telephone calls and e-mails from individuals and businesses who have been contacted...

IRS Finalizes Procedures for Equitable Relief Under IRC Section 6015

On September 16, 2013, the IRS issued Revenue Procedure 2013-34, which establishes new rules for eva...

IRS Clarifies Innocent Spouse Statute of Limitations

In a previous blog article, we addressed the courts invalidating the Internal Revenue Service’s (I...

Effective Tax Administration (ETA) Offer – An Underutilized Option.

In her annual Report to Congress, Nina Olson , the Taxpayer Advocate, pointed out that the IRS is un...

Can I discharge income taxes in bankruptcy?

Yes, under the right circumstances. Income taxes (not trust-fund or withholding taxes) are discharge...

Can I challenge the Internal Revenue Service’s (IRS) decision to pursue me for unpaid taxes?

Yes. You have many options for challenging an IRS assessment. Two common procedures are the Collecti...