On February 21, 2024, the Internal Revenue Service (IRS) announced that it plans to begin dozens of ...

The Challenges for Art Donation (Part 2 of 3): Economic Substance

As discussed in part one of this series on art donations, a taxpayer who wishes to receive a tax ded...

Anticipating Tax Litigation… And the IRS (Part 1 of 2): Tax Filing and Maintenance Tips

Despite the relative rarity of an individual taxpayer’s file being brought to United States Tax Co...

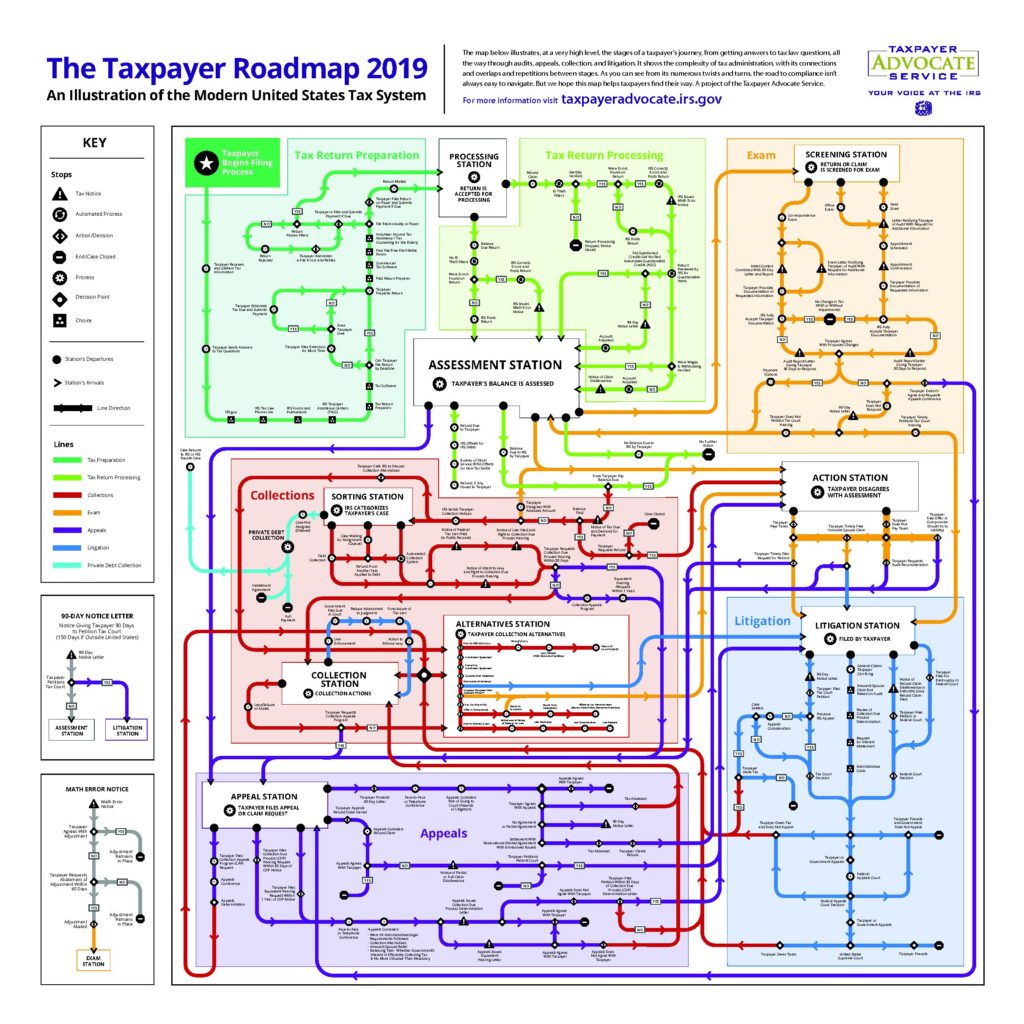

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

Reinstating Defaulted IRS Installment Agreements

Defaulted Installment Agreements The IRS expects taxpayers to pay all of their tax liabilities in fu...

Substantiating Business Expenses in Audits – Special Rules for Travel, Meals and Entertainment, Gifts, and any “Listed” Property Expenses

Substantiating business expenses is a common problem for many businesses going through an audit with...

Substantiating Business Expenses in Audits – Step Four: Proving a Business Expense is “Necessary”

Substantiating business expenses is a common problem for businesses going through an audit wi...

Substantiating Business Expenses in Audits – Step Three: Proving a Business Expense is “Ordinary”

Substantiating business expenses is a common problem for many businesses going through an audit with...

Substantiating Business Expenses in Audits – Step Two: Proving a “Trade or Business” Incurred the Business Expenses

Substantiating business expenses is a common problem for many businesses going through an audit with...

IRS Audits: The Administrative Summons and Defending Against the Administrative Summons

One of the most critical issues a taxpayer can face during an IRS audit is deciding what information...

Substantiating Business Expenses in Audits – Step One: Providing the Documents

Substantiating business expenses is a common problem for many businesses going through an audit with...