The American Rescue Plan Act established the Restaurant Revitalization Fund (RRF) to provide support...

What To Do if I Can’t Pay My Taxes by the IRS’s July 15 Tax Deadline

In light of the current Covid-19 ...

How to Appeal the Trust Fund Recovery Penalty After the Appeal Period has Passed: Offer in Compromise, Doubt as to Liability

There are many reasons businesses fall behind on paying their federal tax liabilities. Falling behin...

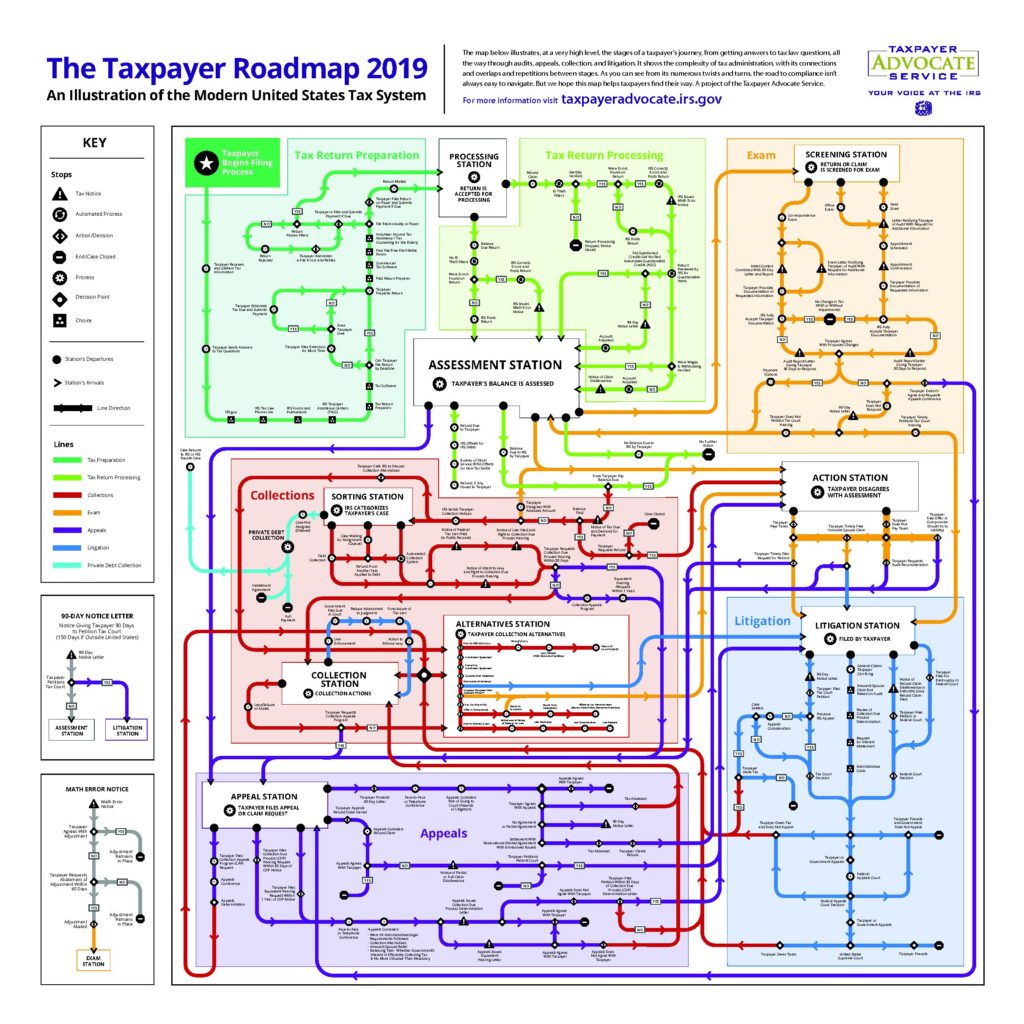

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

Can the IRS Can Foreclose on My Home?

Yes. If you owe money to the Internal Revenue Service (IRS), the IRS has many tools it may use to co...

Can The IRS Really Seize My Assets Without Telling Me First?

The Internal Revenue Service (IRS) can utilize its jeopardy levy function (i.e., taking a taxpayer�...

How Does an Employer Comply with an IRS Wage Levy?

When an individual has outstanding federal tax liabilities, the Internal Revenue Service (IRS) has a...

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible?

Are Sexual Harassment Settlement Payments and Attorney Fees Tax Deductible? It depends on whether th...

Recent Announcements: The IRS to End Offshore Voluntary Disclosure Program on September 28, 2018; FinCEN Increases FBAR Penalties to Reflect Inflation

Offshore Voluntary Disclosure Program Ends September 28, 2018 The IRS recently announced that it wil...

The Jeopardy Levy: Understanding the IRS’s Most Dangerous Levy Action

In certain instances, the IRS can issue a jeopardy levy to seize available assets without the taxpay...

Can I challenge the Internal Revenue Service’s (IRS) decision to pursue me for unpaid taxes?

Yes. You have many options for challenging an IRS assessment. Two common procedures are the Collecti...

IRS Levy – Notices Before Levy

What does it mean when the IRS says it plans to take enforced collection action? Usually, it means t...