It is not uncommon for small businesses to rely on friends and family for loans to assist the busine...

IRS Releases People First Initiative FAQs

On March 25, 2020, the Internal Revenue Service (IRS) announced its “People First Initiative,” a...

IRS Expands Operations And Issues Additional Guidance In Response to Ever-Changing Pandemic Environment

On April 24, 2020, the Internal Revenue Service (IRS) issued an internal memo advising its employees...

Working With Taxing Authorities During The Coronavirus Pandemic

The recently imposed social distancing measures that are critical and essential to our nation’s ba...

IRS To Increase Focus On Delinquent-Filed Returns

The Internal Revenue Service (IRS) announced, in a recent Information Release and Fact Sheet, that i...

Can You Remotely Satisfy The Material Participation Test?

For many taxpayers with multiple active business interests, the material participation test can be a...

Another Tax Blow To The Marijuana Industry

The marijuana industry remains in a difficult position when it comes to the federal tax implications...

FOIAs and GDPAs: How Requests for Information Can Help Practitioners Resolve Cases with the IRS or DOR

This is the sixth article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pra...

FOIAs and GDPAs: How Requests for Information Can Help Practitioners Resolve Cases with the IRS or DOR

This is the fifth article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pra...

FOIAs and GDPAs: How Requests for Information Can Help Practitioners Resolve Cases with the IRS or DOR

This is the fourth article in the Freedom Of Information Act Requests (FOIAs) and Government Data Pr...

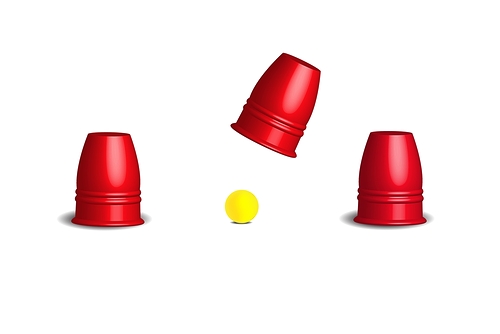

Notice of Right to a Collection Due Process Hearing – Is the IRS Trying to Hide the Ball?

The IRS must give a taxpayer written notice, sent by certified mail, at least 30 days before it take...