Since the COVID-19 pandemic, the Internal Revenue Service (IRS) has had a long backlog that, due in ...

What To Do if I Can’t Pay My Taxes by the IRS’s July 15 Tax Deadline

In light of the current Covid-19 ...

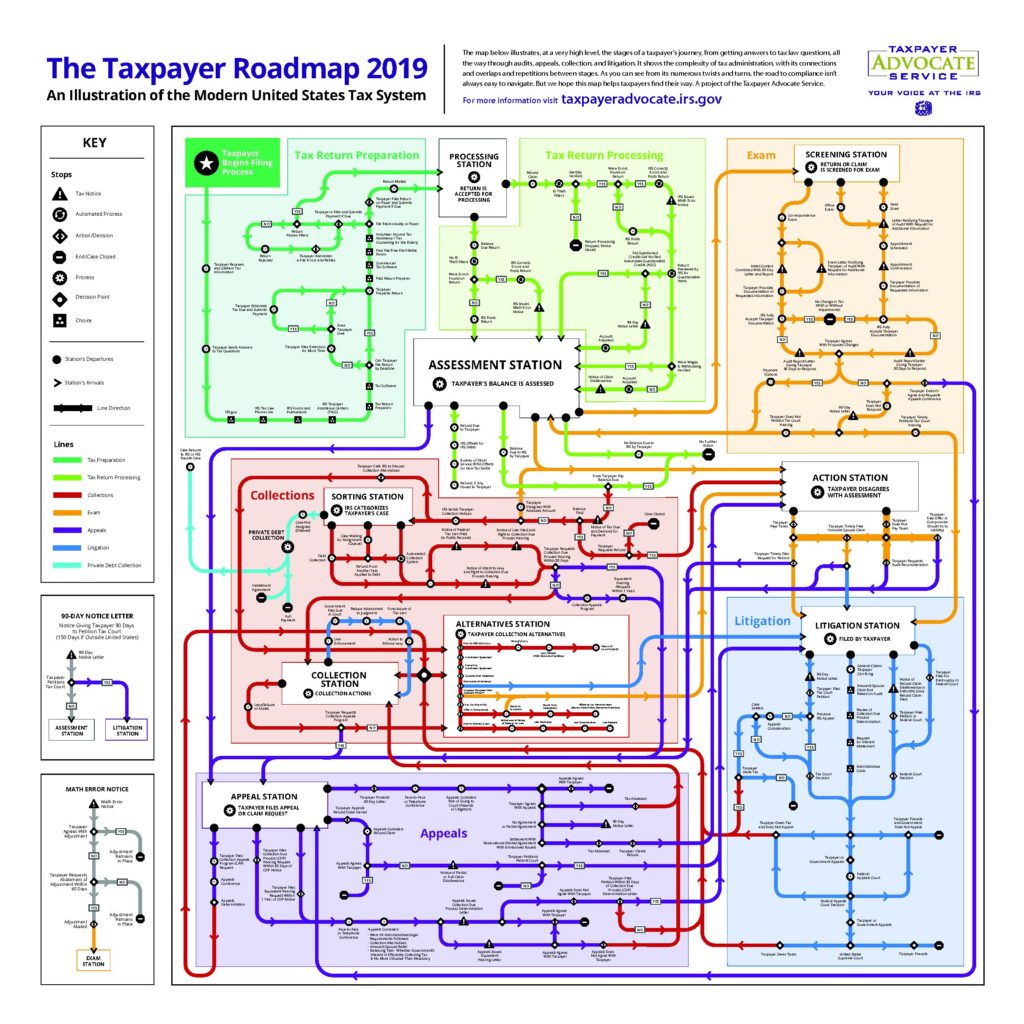

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

How Does an Employer Comply with an IRS Wage Levy?

When an individual has outstanding federal tax liabilities, the Internal Revenue Service (IRS) has a...

IRS Tests Expanded Streamlined Installment Agreement Program

New IRS Test Criteria for Streamlined Installment Agreements: Liabilities Up to $100,000 Eligible fo...

Reinstating Defaulted IRS Installment Agreements

Defaulted Installment Agreements The IRS expects taxpayers to pay all of their tax liabilities in fu...

I Owe the IRS Money – What Can I Do?

We often receive telephone calls and e-mails from individuals and businesses who have been contacted...

Can I challenge the Internal Revenue Service’s (IRS) decision to pursue me for unpaid taxes?

Yes. You have many options for challenging an IRS assessment. Two common procedures are the Collecti...

Installment Agreement – Minnesota Department of Revenue

This is the sixth post in the Collection Options series. This series is dedicated to presenting indi...

Installment Agreement – IRS

This is the fifth post in the Collection Options series. This series is dedicated to presenting indi...