The on-going COVID-19 pandemic has had a dramatic impact on the daily operations for the Internal Re...

What To Do if I Can’t Pay My Taxes by the IRS’s July 15 Tax Deadline

In light of the current Covid-19 ...

How to Appeal the Trust Fund Recovery Penalty After the Appeal Period has Passed: Offer in Compromise, Doubt as to Liability

There are many reasons businesses fall behind on paying their federal tax liabilities. Falling behin...

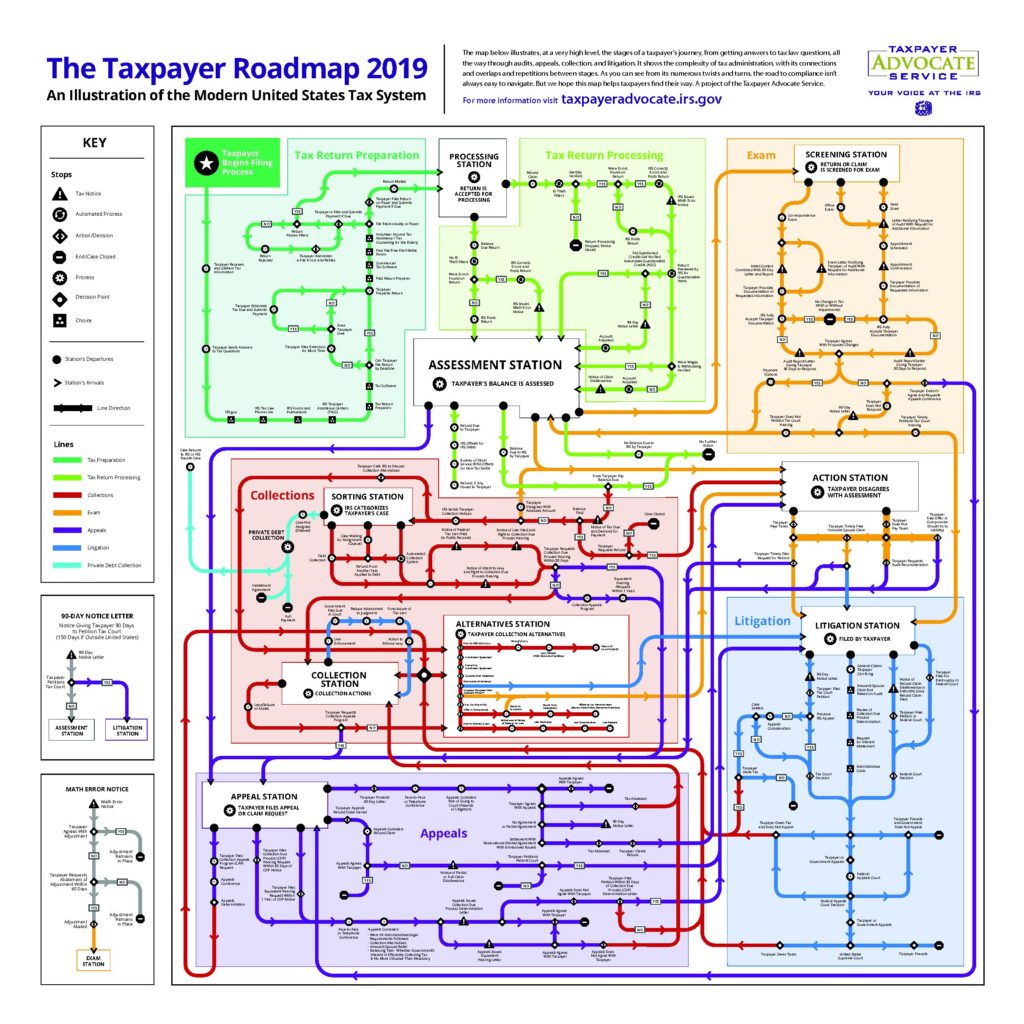

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

Can the IRS Can Foreclose on My Home?

Yes. If you owe money to the Internal Revenue Service (IRS), the IRS has many tools it may use to co...

IRS Tests Expanded Streamlined Installment Agreement Program

New IRS Test Criteria for Streamlined Installment Agreements: Liabilities Up to $100,000 Eligible fo...

Can I challenge the Internal Revenue Service’s (IRS) decision to pursue me for unpaid taxes?

Yes. You have many options for challenging an IRS assessment. Two common procedures are the Collecti...

What Do You Do When the IRS or MDR Does Not Issue A Lien Release?

A tax lien is a mechanism that both the IRS and the MDR use to secure their interest in taxpayers’...

Preventing the Filing of a Notice of Federal Tax Lien

A Notice of Federal Tax Lien (NFTL) can cause irreversible harm to an individual or a business. The ...

Impact of Federal Tax Liens on the Division of Property in Marital Dissolutions

A divorce is usually stressful enough without the added concern of obligations to the IRS. Unfortuna...