There are many reasons businesses fall behind on paying their federal tax liabilities. Falling behin...

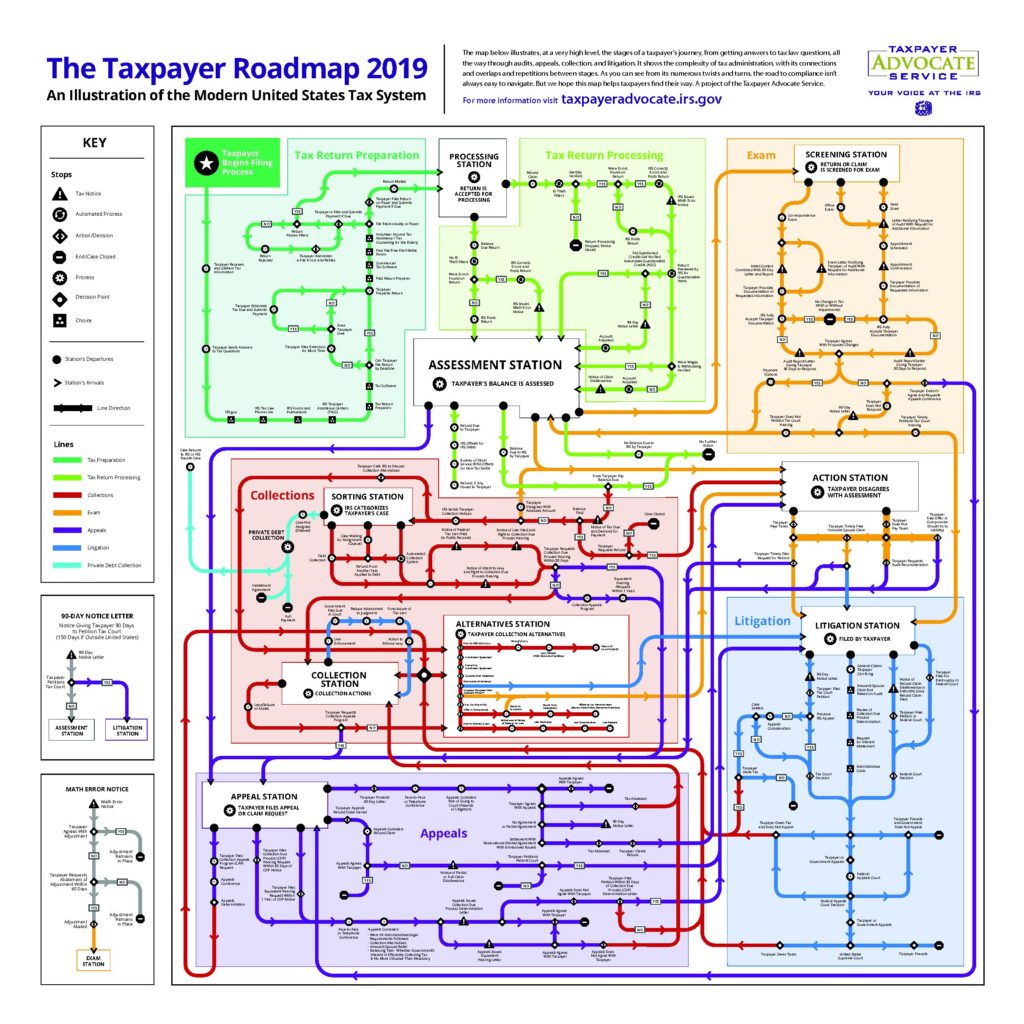

IRS Taxpayer Roadmap

The Internal Revenue Service (IRS) Taxpayer Advocate Service (TAS) recently released the above “su...

IRS Announces Increase to Late Filing Penalties for 2018 Federal Tax Returns

The IRS recently announced that taxpayers who owe tax and did not file their 2018 returns before Fri...

Taking Advantage Of Expanded Penalty Relief

The recent enactment of the Tax Cut and Jobs Act (TCJA) put many individual taxpayers in a difficult...

Claim for Refund of the Trust Fund Recovery Penalty

An individual assessed the Trust Fund Recovery Penalty (TFRP) has the option to pay just a portion o...

IRS Clarifies Innocent Spouse Statute of Limitations

In a previous blog article, we addressed the courts invalidating the Internal Revenue Service’s (I...

The Potential Problems Taxpayers Face When Waiting Until the Last Minute to Timely File Amended Returns

Waiting until the last minute is nearly always a bad strategy. This is certainly true in tax prepara...

Can I Recover Income Tax Refunds When I File My Returns Late?

Many individuals and businesses fail to file their income tax returns for multiple years for a varie...

Filing a Claim for Refund of Federal Taxes

Sometimes a situation arises when a taxpayer overpays his or her taxes for a particular year. When a...