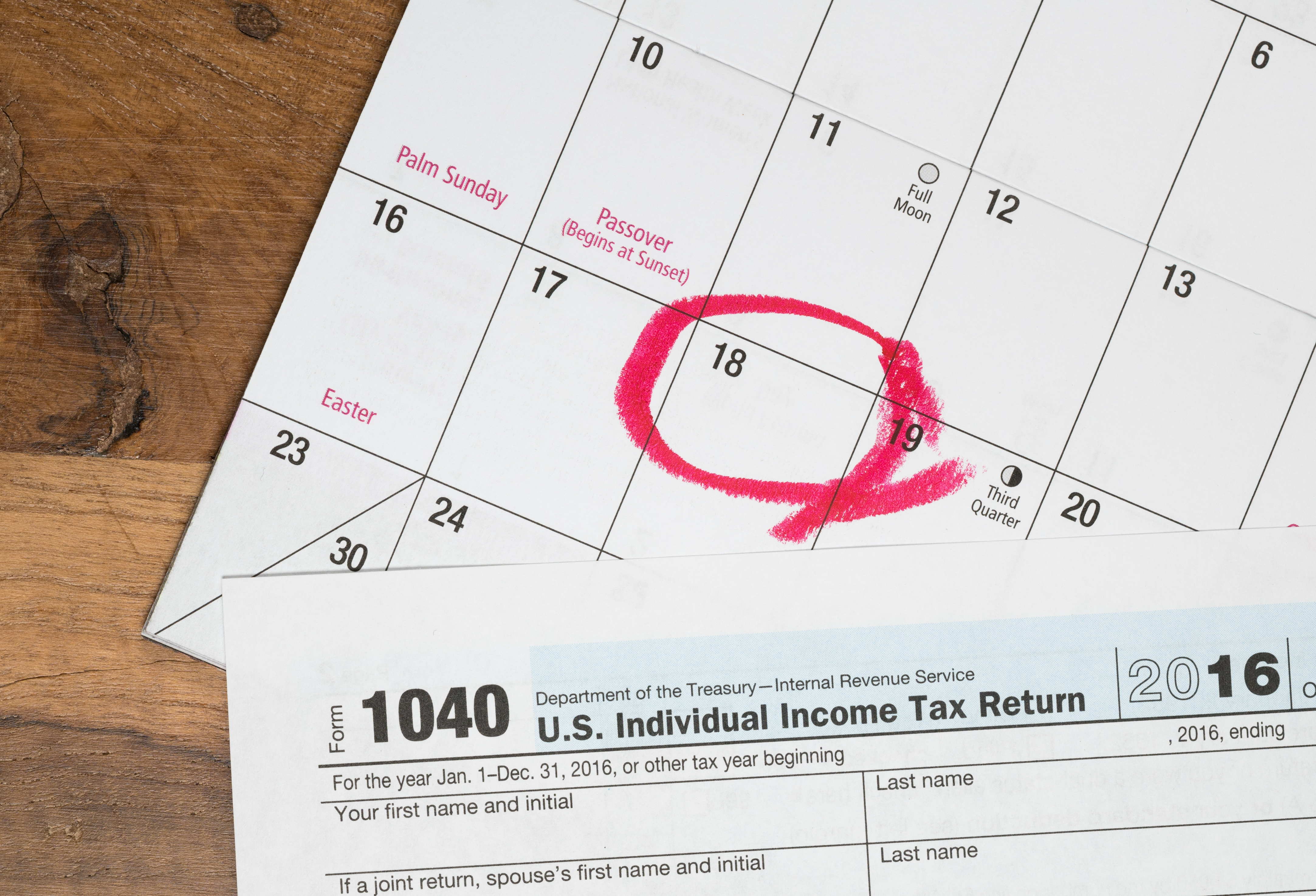

I missed the deadline to file my tax return. Now what?

The deadline for individual taxpayers to file their 2017 Forms 1040, U.S. Individual Income Tax Return, was April 18, 2018. Generally, the filing deadline for Forms 1040 is April 15 of the following tax year. However, as was the case for the 2017 filing deadline, the deadline may change when it falls on a weekend or federal holiday (or if the Internal Revenue Service (IRS) website experiences technical difficulties).

Individuals may miss the return filing deadline for many reasons. Individuals may neglect to timely file their return due to unfortunate circumstances outside of their control, such as the death or serious illness of the individual or a member of the individual’s immediate family. Some taxpayers simply forget or find themselves too busy to timely file their return. Other individuals choose not to file their return because they believe that not filing their return may help them to avoid IRS scrutiny for one reason or another.

In this article, we examine the benefits of filing a return as soon as possible, even if the individual has missed the filing deadline, to reduce the accrual of penalties and interest and to limit the period of time during which the IRS may pursue collection action, such as levy action, against the individual to collect the outstanding liabilities. We also address the options that a taxpayer may have to resolve their outstanding tax liability if the taxpayer is not able to pay their tax debt in full at the time of filing. Finally, we address requests to the IRS for relief from penalties for an individual’s late-filing of their income tax return.

File your return as soon as possible to limit penalties and interest.

Late-Filing Penalty

Individuals who miss the filing deadline generally benefit from filing their late return as soon as possible to limit the accumulation of the late-filing penalty. This penalty is usually 5% of the tax liability owing for each month or part of a month that a return is late. This penalty can add up quickly. The penalty, and associated interest, starts accruing the day after the tax filing due date. The penalty generally may not exceed 25 percent of the unpaid taxes. If a return is filed more than 60 days after the due date, the minimum penalty is either $205 or 100 percent of the unpaid tax, whichever is less.

Interest

Interest compounds daily and starts accumulating on unpaid taxes one day after the due date of the return, until the bill is fully paid off. The interest rate is subject to change and is currently 4.18% (3% on top of the current federal short-term rate of 1.18%).

Late-Payment Penalty

The late-payment penalty is 0.5% (1/2 of 1 percent) of the additional tax owed amount for every month (or fraction thereof) the owed tax remains unpaid, up to a maximum of 25%. For any month(s) in which both the late-payment and late-filing penalties apply, the 0.5% late-payment penalty is waived. This amount can change if the taxpayer negotiates an Installment Agreement to resolve their outstanding obligations.

The IRS collection power is generally capped at 10 years from the date the return is filed.

The IRS generally has 10 years from the date a taxpayer files their return to collect the tax owing through enforced collection action such as liens and levies. See IRC 6502 and IRM 1.5.19. Hence, a taxpayer benefits from filing their return as soon as possible because filing their return triggers the ticking of the collection clock. If the taxpayer does not file their return, and the IRS does not prepare a substitute for return or audit the taxpayer, the IRS could potentially maintain indefinite collection power against the taxpayer.

What if I am due a refund?

The late-filing and late-payment penalties do not apply in the circumstance that a taxpayer is due a refund. However, a taxpayer due a refund generally must file their return within three years from the filing deadline. Otherwise, the taxpayer is generally statutorily time-barred from claiming their refund.

What if I cannot pay the liability owing when I file my tax return?

The IRS offers various programs for taxpayers to resolve their tax liabilties when the taxpayer is not able to immediately full-pay their liabilities. Some of the most commonly used programs include Installment Agreements and Offers in Compromise.

Installment Agreement

An Installment Agreement is essentially a payment plan to either fully or partially pay the liability over time. The ease of obtaining an Installment Agreement and the amount of the monthly payment depend on a number of factors, including the amount of tax owing and the taxpayer’s financial circumstances. More information regarding Installment Agreements may be found here and here.

Offer in Compromise

An Offer in Compromise is an offer to pay less than the outstanding liability within a relatively short period of time (generally six months) to settle the debt in full. Offers in Compromise are generally only available when a taxpayer can show the IRS that the taxpayer’s financial circumstances are such that the taxpayer will not be able to fully pay the liability within a reasonable period of time, even with an Installment Agreement. The taxpayer must provide the IRS financial documentation that verifies the value of their equity in assets and their monthly excess income. This documentation must show that the taxpayer’s equity in assets and monthly income are low relative to the tax debt owing. The taxpayer generally must make the IRS a settlement offer equal to or greater than their equity in assets and the present value of their future monthly excess income. More information regarding Offers in Compromise may be found here.

Can the IRS remove the penalties assessed against me?

There are generally two ways for the IRS to abate late-filing and late-payment penalties: (1) first time penalty abatement or (2) penalty relief due to reasonable cause. Below we address some of the requirements for each of these requests for penalty relief.

First time penalty abatement

First time penalty abatement is a good option for taxpayers with a history of timely filing and paying their taxes. A taxpayer will usually qualify for this kind relief from penalties if the taxpayer has not been assessed penalties for the past three years and meets the following requirements:

- The taxpayer has filed all currently required returns or filed an extension of time to file; and

- The taxpayer has paid, or arranged to pay, any tax due.

More information regarding first time penalty abatement may be found here.

Penalty relief due to reasonable cause

A taxpayer may receive penalty relief if there was reasonable cause for the taxpayer’s late-filing or late-payment of their tax liabilities. The IRS will consider all facts and circumstances presented by the taxpayer to determine whether the taxpayer had reasonable cause for late-filing their return or late-paying their taxes. Generally, the taxpayer must show that the taxpayer used all ordinary business care and prudence to meet the requirements to file their return or pay their taxes on time, but the taxpayer was nevertheless unable to do so.

Facts considered by the IRS to determine reasonable cause

- What happened and when did it happen?

- What facts and circumstances prevented the taxpayer from timely filing their return or paying their taxes?

- How did the facts and circumstances affect the taxpayer’s ability to timely file and/or pay their taxes?

- How did the facts and circumstances affect the taxpayer’s ability perform their other day-to-day responsibilities?

- After the facts and circumstances changed, what actions did the taxpayer take to file and/or pay their taxes?

Documents taxpayers may need to show reasonable cause

Most reasonable cause explanations require documentation to support the claim. This documentation may include:

- Hospital or court records or a letter from a physician to establish illness or incapacitation, with specific start and end dates.

- Documentation of natural disasters or other events that prevented compliance.

More information regarding IRS abatement of penalties for reasonable cause may be found here.

Is interest relief available?

Interest itself cannot be abated. Interest charged on a penalty will be reduced or removed when that penalty is reduced or removed. If an unpaid balance remains on the taxpayer’s account, interest will continue to accrue until the account is fully paid. More information regarding IRS interest charges may be found here.

Conclusion

Depending on the circumstances and the liabilities at issue, late-filing taxpayers may benefit from professional guidance in evaluating their options to most efficiently resolve their tax liabilities and get back into compliance with the federal tax laws. Our firm assists numerous taxpayers in these circumstances. If you have questions, please contact us.